About: This interdisciplinary combined course and trip begins with classroom instruction Term 7 and culminates with travel to France, offerent students a firsthand experience related to their five-week classroom studies. This course, taught in French, focuses on essential themes in French history and culture, utilizing authentic materials such as press articles, videos, podcasts, historical documents, comic books, children’s books for assessment in listening, speaking, reading and writing and writing skills. Topics include the discovery of prehistoric cave art, Roman Gaul, and Quaker history in France, with a particular emphasis on Paris and the South of France. Environmental considerations in travel, such dining and transportation choices, are integrated. We will be spending 10 days at La Maison Quaker in Congénies, 3 days in Sarlat, and 3 days in Paris before returning to the States. This program involves collaborative efforts with the aging Quaker community at La Maison Quaker in the South of France. Activities include restoring historic gravestones, preserving Quaker life stories and learning the art of boutis for contributing to a quilt panel representing La Maison Quaker.

Requirements: Participants should be available for a weekend training session during Term 7, and they will share their reflections on George School’s social media before the trip’s conclusion. Physical requirements include the ability to complete 3-5 hours of work each day during the service portion of the trip with the range of motion expected for a variety of typical household tasks (bending, lifting, scrubbing), manage their own luggage on public transportation and on foot, and walk an average of 20,000 steps on days when we are sightseeing.

Prerequisites Two mods of French III or higher. This course may not count as the third term for IB SL and HL candidates. However, it could be added as an elective fourth mod. Bilingual students (French – English) are encouraged to apply.

Course Credits: Students earn 1 credit in language and fulfill their service learning requirement. IB diploma candidates in the class of 2026 will be able to use this experience for their Creativity, Activity, and Service (CAS) project.

Trip Leader: Theresa Montagne

Trip Cost: $4,895

Joellen Paget Gillon (2015)

Joellen Paget Gillon (2015) Caroline Hedde (2019)

Caroline Hedde (2019) Alejandra Carranza (2022)

Alejandra Carranza (2022) Dr. Mariam Mahmud (2020)

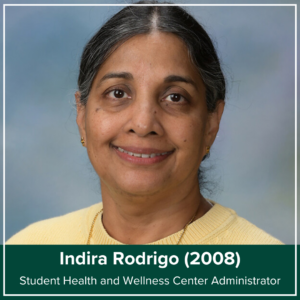

Dr. Mariam Mahmud (2020) Indira Rodrigo (2008)

Indira Rodrigo (2008)

Monastir, Tunisia, and Amman, Jordan

Monastir, Tunisia, and Amman, Jordan Irvine, CA

Irvine, CA Feasterville-Trevose, PA

Feasterville-Trevose, PA New Hope, PA (Previously NYC)

New Hope, PA (Previously NYC) Richboro, PA

Richboro, PA Englewood, NJ

Englewood, NJ Ningbo, Zhejiang, China

Ningbo, Zhejiang, China Willingboro, NJ

Willingboro, NJ Yardley, PA

Yardley, PA Newtown, PA

Newtown, PA Holicong, PA

Holicong, PA Newtown, PA

Newtown, PA Hamilton, NJ

Hamilton, NJ Yardley, PA

Yardley, PA Lambertville, NJ

Lambertville, NJ Chongqing, China

Chongqing, China Pennington, NJ

Pennington, NJ Yardley, PA

Yardley, PA Bensalem, PA

Bensalem, PA Borgota, Colombia

Borgota, Colombia Newtown, PA

Newtown, PA Burlington, NJ

Burlington, NJ Langhorne, PA

Langhorne, PA Princeton, NJ

Princeton, NJ Langhorne, PA

Langhorne, PA New York City, NY

New York City, NY New Hope, PA

New Hope, PA St. Catharines, Ontario, Canada

St. Catharines, Ontario, Canada Providenciales, Turks and Caicos Islands

Providenciales, Turks and Caicos Islands Willingboro, NJ

Willingboro, NJ Princeton, NJ

Princeton, NJ

Newark, NJ

Newark, NJ Trenton, NJ

Trenton, NJ Newtown, PA

Newtown, PA

Lawrence, NJ

Lawrence, NJ Seoul, South Korea

Seoul, South Korea

Milwaukee, Wisconsin

Milwaukee, Wisconsin Pennington, NJ

Pennington, NJ Jenkintown, PA

Jenkintown, PA Ottsville, PA

Ottsville, PA Yardley, PA

Yardley, PA Providenciales, Turks and Caicos Islands

Providenciales, Turks and Caicos Islands Hopewell, NJ

Hopewell, NJ

Pottstown, PA

Pottstown, PA Playa del Carmen, Quintana Roo, México

Playa del Carmen, Quintana Roo, México Shanghai, China

Shanghai, China Beijing, China

Beijing, China Yardley, PA

Yardley, PA Beijing, China

Beijing, China Holland, PA

Holland, PA Langhorne, PA

Langhorne, PA Ringoes, NJ

Ringoes, NJ New Hope, PA

New Hope, PA Dreshner, PA

Dreshner, PA Yardley, PA

Yardley, PA Yardley, PA

Yardley, PA PA

PA

Xi’an, China

Xi’an, China