Pennsylvania Tax Credit Programs

Turn your tax dollars into scholarships for GS students!

Fund transformative scholarships for George School students through Pennsylvania tax credit programs

The Educational Improvement Tax Credit (EITC) and Opportunity Scholarship Tax Credit (OSTC) programs allow companies who operate and pay taxes in Pennsylvania to redirect a portion of their tax liability to George School as a philanthropic gift for financial aid.

Eligibility

Eligible businesses must be authorized to operate in Pennsylvania and are subject to Pennsylvania state taxes such as: Personal Income Tax, Corporate Net Income Tax, Corporate Stock/Foreign Trade Franchise Tax, and several others.

Benefits to Your Company

By making a gift directly to George School’s financial aid program, businesses can receive a substantial tax credit of either 75 percent or 90 percent in Pennsylvania taxes, and can donate up to $750,000.

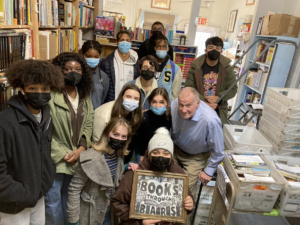

Benefits to George School

In the last three years, Pennsylvania businesses committed to education have gifted nearly $400,000 to George School through these tax credit programs. These donations create more opportunities to provide deserving students access to a transformative educational experience by directly supporting the school’s financial aid program.

Application Process

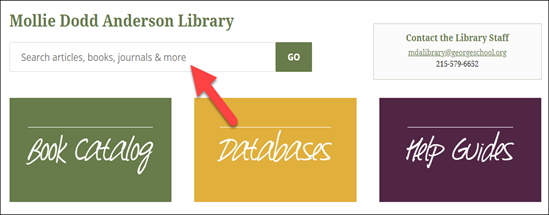

- Visit www.georgeschool.org/eitc or www.georgeschool.org/ostc to apply.

- To learn more about the step-by-step electronic application process, please read this walkthrough from the Pennsylvania Department of Community & Economic Development (DCED).

- New business participants should submit their applications by July 1.

Resources

How to Apply for Businesses

How to Apply for Individuals

EITC Information & Application

OSTC Information & Application

Important Dates

May 15

Business who have fulfilled their two-year commitment can reapply for a new two-year commitment.

Businesses in the middle of their two-year commitment can renew for a second year.

July 1

All other businesses including initial applicants can submit their applications.

Contact

Chris Jackiewicz

Leadership Gifts Officer

215.579.6572

cjackiewicz@georgeschool.org

Frequently Asked Questions

What is the difference between EITC and OSTC?

Both programs provide tuition assistance support to qualified students from low-income households and the tax benefit is identical. The OSTC program is slightly more restrictive, as the dollars can only support students whose neighborhood public school is low-achieving.

What businesses and taxes are eligible?

Businesses authorized to do business in Pennsylvania who are subject to one or more of the following taxes:

- Personal Income Tax

- Capital Stock/Foreign Franchise Tax

- Corporate Net Income Tax

- Bank Shares Tax

- Title Insurance & Trust Company Shares Tax

- Insurance Premium Tax (excluding surplus lines, unauthorized, domestic/foreign marine)

- Mutual Thrift Tax

- Malt Beverage Tax

- Retaliatory Fees under section 212 of the Insurance Company Law of 1921

How do I apply?

Visit www.georgeschool.org/eitc or www.georgeschool.org/ostc to apply.

Applications from businesses who are already in the program will be accepted online beginning May 15.

Applications from businesses new to the program will be accepted beginning July 1. Please note that applications are accepted on a “first come, first serve” basis and are used up almost immediately, so it is important for new businesses to submit by July 1.

Contact Chris Jackiewicz at cjackiewicz@georgeschool.org or 215.579.6572 if you have any questions about the EITC or OSTC programs.

What happens after I submit my application?

The Department of Community and Economic Development (DCED) will send an approval letter to businesses that have been awarded tax credits. The timing of these letters varies from year to year. George School will be in contact with businesses who have let us know about their application when there are any updates from DCED.

If your company is approved, you must make a contribution to George School within 60 days of receipt of your approval letter from the DCED. Once George School receives your contribution, we will send you an acknowledgement letter, which you must send to DCED within 90 days of the date of your approval letter.

I don’t own a business. Am I eligible?

Thanks to a new partnership with The Friends Collaborative, some individuals may be eligible to receive tax credits while helping to support George School’s financial aid program. An increasing number in the George School community have been taking advantage of this new opportunity. The tax benefit for individuals is the same as for businesses, but the process to apply for the credits is slightly different. For more information, next steps, or to connect with a George School family who participates in PA State Tax Credit Programs through personal taxes, contact Chris Jackiewicz at 215.579.6572 or cjackiewicz@georgeschool.org.

Joellen Paget Gillon (2015)

Joellen Paget Gillon (2015) Caroline Hedde (2019)

Caroline Hedde (2019) Alejandra Carranza (2022)

Alejandra Carranza (2022) Dr. Mariam Mahmud (2020)

Dr. Mariam Mahmud (2020) Indira Rodrigo (2008)

Indira Rodrigo (2008)

Monastir, Tunisia, and Amman, Jordan

Monastir, Tunisia, and Amman, Jordan Irvine, CA

Irvine, CA Feasterville-Trevose, PA

Feasterville-Trevose, PA New Hope, PA (Previously NYC)

New Hope, PA (Previously NYC) Richboro, PA

Richboro, PA Englewood, NJ

Englewood, NJ Ningbo, Zhejiang, China

Ningbo, Zhejiang, China Willingboro, NJ

Willingboro, NJ Yardley, PA

Yardley, PA Newtown, PA

Newtown, PA Holicong, PA

Holicong, PA Newtown, PA

Newtown, PA Hamilton, NJ

Hamilton, NJ Yardley, PA

Yardley, PA Lambertville, NJ

Lambertville, NJ Chongqing, China

Chongqing, China Pennington, NJ

Pennington, NJ Yardley, PA

Yardley, PA Bensalem, PA

Bensalem, PA Borgota, Colombia

Borgota, Colombia Newtown, PA

Newtown, PA Burlington, NJ

Burlington, NJ Langhorne, PA

Langhorne, PA Princeton, NJ

Princeton, NJ Langhorne, PA

Langhorne, PA New York City, NY

New York City, NY New Hope, PA

New Hope, PA St. Catharines, Ontario, Canada

St. Catharines, Ontario, Canada Providenciales, Turks and Caicos Islands

Providenciales, Turks and Caicos Islands Willingboro, NJ

Willingboro, NJ Princeton, NJ

Princeton, NJ

Newark, NJ

Newark, NJ Trenton, NJ

Trenton, NJ Newtown, PA

Newtown, PA

Lawrence, NJ

Lawrence, NJ Seoul, South Korea

Seoul, South Korea

Milwaukee, Wisconsin

Milwaukee, Wisconsin Pennington, NJ

Pennington, NJ Jenkintown, PA

Jenkintown, PA Ottsville, PA

Ottsville, PA Yardley, PA

Yardley, PA Providenciales, Turks and Caicos Islands

Providenciales, Turks and Caicos Islands Hopewell, NJ

Hopewell, NJ

Pottstown, PA

Pottstown, PA Playa del Carmen, Quintana Roo, México

Playa del Carmen, Quintana Roo, México Shanghai, China

Shanghai, China Beijing, China

Beijing, China Yardley, PA

Yardley, PA Beijing, China

Beijing, China Holland, PA

Holland, PA Langhorne, PA

Langhorne, PA Ringoes, NJ

Ringoes, NJ New Hope, PA

New Hope, PA Dreshner, PA

Dreshner, PA Yardley, PA

Yardley, PA Yardley, PA

Yardley, PA PA

PA

Xi’an, China

Xi’an, China